Delving into the realm of public and private health insurance in Asia, this introduction aims to provide a comprehensive look at the key distinctions between the two systems. From accessibility to quality of care, we will navigate through the intricacies of healthcare coverage in the region.

As we delve deeper into the nuances of public and private health insurance in Asia, we uncover the various factors that shape healthcare provision and utilization across different countries.

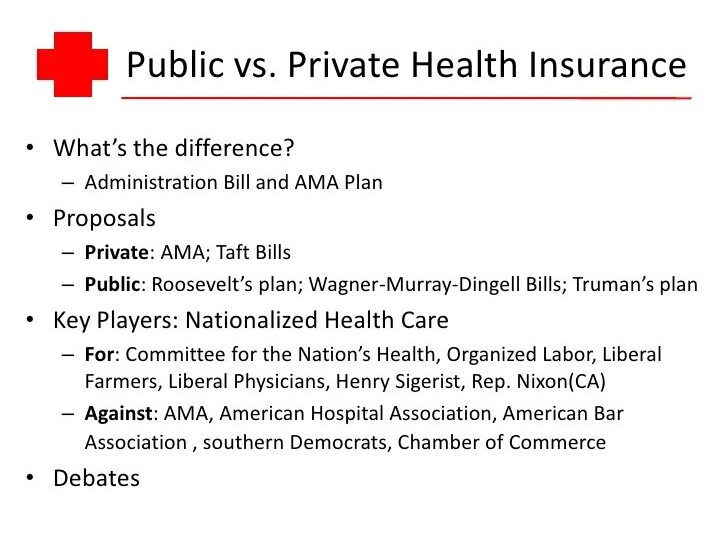

Overview of Public and Private Health Insurance

Public health insurance in Asia is typically government-funded and aims to provide coverage to a large portion of the population. It is often mandatory and funded through taxes or social security contributions. Public health insurance offers basic healthcare services and treatments, focusing on preventive care and essential medical needs.Private health insurance in Asia, on the other hand, is purchased by individuals or employers from private insurance companies.

It offers a wider range of coverage options, including faster access to specialized care, elective procedures, and additional services not covered by public insurance. Private health insurance plans can be tailored to individual needs and preferences.

Comparison of Coverage Provided by Public and Private Health Insurance

Public Health Insurance:

- Provides coverage to a larger population, including low-income individuals and those without access to private insurance.

- Focuses on basic healthcare services, preventive care, and essential treatments.

- May have longer wait times for non-emergency procedures due to high demand.

- Costs are generally lower as they are subsidized by the government.

Private Health Insurance:

- Offers a wider range of coverage options, including specialized care, elective procedures, and additional services.

- Provides faster access to medical care and treatments compared to public insurance.

- Allows for more personalized plans tailored to individual needs and preferences.

- Costs are higher as individuals or employers pay premiums for private insurance coverage.

Accessibility and Affordability

In Asia, the accessibility of public health insurance varies significantly across different countries. Some nations have well-established systems that provide comprehensive coverage to their citizens, while others struggle to reach remote or marginalized populations.

Accessibility of Public Health Insurance

Public health insurance programs in countries like Japan, South Korea, and Singapore are known for their accessibility and efficiency. These nations have high population coverage rates and offer a wide range of services to their residents. However, in countries with developing healthcare systems, such as Cambodia or Laos, access to public health insurance can be limited due to inadequate infrastructure and funding.

Affordability of Private Health Insurance

Private health insurance in Asia is often seen as a more expensive option compared to public health insurance. Premiums for private plans can be high, making them unaffordable for many individuals, especially those from lower-income backgrounds. This disparity in cost can lead to unequal access to quality healthcare services.

Impact on Health Service Utilization

The accessibility and affordability of health insurance directly impact the utilization of health services in Asia. Individuals who cannot afford private insurance may rely on public healthcare facilities, leading to overcrowding and longer wait times. On the other hand, those with private insurance may receive faster and more specialized care, potentially widening the healthcare gap between different socio-economic groups.

Quality of Care

Public and private health insurance play a significant role in determining the quality of healthcare services in Asia. Let's delve into the differences in the quality of care offered by these two systems and their impact on patient outcomes.

Public Health Insurance Systems in Asia

Public health insurance systems in Asia vary in quality of care depending on the country. In some countries, public healthcare facilities may be overcrowded and understaffed, leading to longer wait times and potentially lower quality of care. However, in other countries, public health insurance may provide access to high-quality healthcare services, especially for low-income individuals who cannot afford private insurance

- Public health insurance systems in countries like Japan and South Korea are known for providing high-quality care to their beneficiaries.

- Government hospitals in these countries are equipped with state-of-the-art technology and highly trained medical professionals.

- Patients under public health insurance in these countries often have access to a wide range of medical treatments and services.

Private Health Insurance Companies in Asian Countries

Private health insurance companies in Asia are known for offering a higher level of personalized care and faster access to healthcare services compared to public health insurance. However, the quality of care provided by private insurers may vary depending on the premiums paid and the coverage included in the insurance plan.

- Private health insurance companies in countries like Singapore and Hong Kong are known for their efficient and high-quality healthcare services.

- Patients with private health insurance often have shorter wait times for appointments and procedures, leading to quicker diagnosis and treatment.

- Private hospitals and clinics affiliated with private insurers may offer luxurious amenities and specialized care tailored to the needs of the patient.

Differences in Patient Outcomes

Patient outcomes can differ between public and private health insurance beneficiaries in Asia due to various factors such as access to healthcare facilities, quality of care, and affordability of treatments. While private health insurance may offer faster access to care and a more personalized experience, public health insurance can provide essential healthcare services to a larger segment of the population, ensuring better overall health outcomes for the community.

- Studies have shown that patients under private health insurance may have better health outcomes for certain conditions due to quicker access to specialized treatments.

- On the other hand, public health insurance has been instrumental in improving overall population health by providing preventive care and essential treatments to a broader segment of society.

- The quality of care and patient outcomes in both public and private health insurance systems ultimately depend on the healthcare infrastructure, government policies, and the effectiveness of insurance coverage in each Asian country.

Regulation and Oversight

When it comes to public health insurance in Asia, the regulatory framework varies from country to country. However, most Asian countries have government-run agencies that oversee and regulate public health insurance programs to ensure they are meeting the needs of the population.

Regulation of Private Health Insurance Companies

- In many Asian countries, private health insurance companies are regulated by government agencies that set guidelines and standards for their operations.

- These regulations often include requirements for financial stability, coverage options, and customer service standards to protect consumers.

- Private health insurance companies may also be required to obtain licenses and comply with specific laws and regulations to operate in the market.

Government Oversight in Public and Private Health Insurance

- Government oversight plays a crucial role in ensuring the effectiveness and sustainability of both public and private health insurance systems in Asia.

- Public health insurance programs are closely monitored by government agencies to ensure they are providing adequate coverage and quality care to the population.

- Similarly, government oversight of private health insurance companies helps to prevent fraud, ensure fair practices, and protect consumers from unethical behavior.

- Government agencies may conduct audits, investigations, and inspections to monitor compliance with regulations and take actions against entities that violate the rules.

Wrap-Up

In conclusion, the discussion on the difference between public and private health insurance in Asia sheds light on the complex landscape of healthcare options available to individuals. By understanding the unique features of each system, we can better appreciate the challenges and opportunities in ensuring quality healthcare for all.

Answers to Common Questions

What are the key features of public health insurance in Asia?

Public health insurance in Asia is typically funded by the government and provides coverage to all citizens, offering basic healthcare services at low or no cost.

How does the affordability of private health insurance compare to public health insurance in Asia?

Private health insurance in Asia is often more expensive than public options, catering to those who seek more comprehensive coverage and faster access to healthcare services.

Is there a significant difference in patient outcomes between public and private health insurance beneficiaries in Asia?

While both public and private health insurance systems in Asia aim to provide quality care, disparities in resources and access may lead to variations in patient outcomes.