Navigating the world of health insurance can be overwhelming, but when it comes to mental health coverage, it's essential to make informed decisions. This guide delves into the intricacies of choosing health insurance that prioritizes mental well-being, offering insight and clarity for those seeking the right coverage.

Importance of Mental Health Coverage in Health Insurance

Having mental health coverage in health insurance policies is crucial for overall well-being and quality of life. It ensures that individuals have access to necessary mental health services without financial burden, leading to better mental health outcomes.

Impact on Overall Well-being

- Access to therapy sessions with psychologists or counselors

- Coverage for psychiatric consultations and medication

- Inpatient and outpatient mental health treatment

- Support for substance abuse and addiction treatment

Factors to Consider When Choosing Health Insurance with Mental Health Coverage

When selecting health insurance with mental health coverage, there are several key factors to keep in mind to ensure you have access to the care you need. Understanding these factors can help you make an informed decision that meets your mental health needs.

Network Coverage for Mental Health Providers

- Check if the insurance plan has a network of mental health providers that you can access. In-network providers typically have lower out-of-pocket costs compared to out-of-network providers.

- Ensure that the mental health professionals you prefer to see are included in the network. Having a wide range of providers to choose from can increase the chances of finding the right fit for your needs.

Co-pays, Deductibles, and Out-of-Pocket Expenses

- Understand the co-pays for mental health services, which are the fixed amount you pay for each visit or service. Compare these costs across different insurance plans to find the most affordable option.

- Be aware of the deductible, which is the amount you must pay out of pocket before your insurance coverage kicks in. Lower deductibles can make mental health care more accessible and affordable.

- Consider the out-of-pocket expenses, including any coinsurance or additional costs you may need to cover. Factor in these expenses when evaluating the overall affordability of the insurance plan.

In-Network vs. Out-of-Network Mental Health Services

- Know the difference between in-network and out-of-network mental health services. In-network providers have negotiated rates with the insurance company, resulting in lower costs for you.

- Out-of-network providers may have higher fees, and you may be responsible for a larger portion of the bill. Understanding these distinctions can help you make informed choices about where to seek mental health care.

Types of Mental Health Services Covered by Health Insurance

When it comes to mental health services covered by health insurance, it is important to understand the range of options available for individuals seeking support for their mental well-being. Insurance plans may vary in terms of coverage, but here are some common mental health services that may be covered:

Therapy and Counseling

- Individual therapy sessions with a licensed therapist or counselor.

- Group therapy sessions for specific mental health conditions or concerns.

- Family therapy sessions to address relational dynamics and support systems.

Psychiatric Evaluations

- Assessment by a psychiatrist to diagnose mental health conditions.

- Evaluation of symptoms and history to determine appropriate treatment plans.

- Monitoring of mental health progress and adjustments to treatment as needed.

Medication Management

- Coverage for prescription medications used to treat mental health disorders.

- Consultations with a psychiatrist or medical provider for medication adjustments.

- Monitoring of medication effectiveness and potential side effects.

Inpatient Treatment

- Coverage for hospitalization in a mental health facility for intensive treatment.

- 24/7 care and supervision for individuals experiencing severe mental health crises.

- Therapeutic interventions and support during inpatient stays.

It is essential to review your insurance plan to understand the specific details and limitations of mental health coverage. Some plans may have restrictions on the number of therapy sessions covered or the types of medications included in the formulary.

Evaluating the Quality of Mental Health Coverage in Health Insurance Plans

When evaluating the quality of mental health coverage in health insurance plans, it is important to consider various factors that can impact the accessibility and effectiveness of the services provided. Comparing the offerings of different insurance providers and researching their reputation in the field of mental health coverage can help you make an informed decision.

Assessing Accessibility and Availability of Mental Health Services

Before choosing a health insurance plan, it is crucial to assess the accessibility and availability of mental health services offered by different providers. Look for information on the number of mental health professionals in the network, waiting times for appointments, and coverage for emergency services.

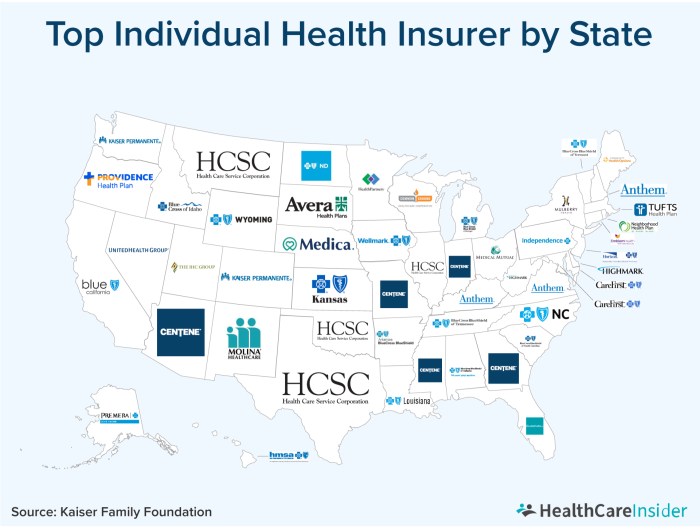

Comparing Reputation of Insurance Companies

Researching and evaluating the reputation of insurance companies in providing mental health coverage can give you insight into their commitment to quality care. Look for reviews from current policyholders, ratings from independent agencies, and any awards or recognitions received for mental health services.

Understanding Mental Health Parity Laws and Regulations

When it comes to mental health parity laws and regulations, it is essential to understand the concept and how they impact insurance coverage for mental health services. These laws ensure that mental health conditions are covered on par with physical health conditions, preventing discrimination against individuals seeking mental health treatment.

Implications of Mental Health Parity

Mental health parity laws require insurance plans to cover mental health services at the same level as physical health services. This means that individuals cannot be charged higher co-pays or face stricter limits on the number of visits for mental health treatment compared to other medical treatments.

By enforcing mental health parity, these laws aim to reduce the stigma associated with mental health issues and improve access to necessary mental health services for those who need them.

Examples of Improved Access

- Before mental health parity laws, many insurance plans had higher out-of-pocket costs and stricter limitations for mental health services, making it difficult for individuals to access the care they needed.

- With the implementation of mental health parity laws, more people have been able to seek mental health treatment without facing financial barriers or discriminatory practices from insurance providers.

- Research has shown that increased access to mental health services as a result of these laws has led to better mental health outcomes and reduced overall healthcare costs in the long run.

Final Review

As we wrap up our exploration of choosing health insurance with mental health coverage, remember that your mental health is just as important as your physical well-being. By understanding the key factors and types of services covered, you can make a decision that supports your overall health and happiness.

Detailed FAQs

What should I consider when choosing health insurance with mental health coverage?

Key factors to consider include network coverage for mental health providers, understanding co-pays, deductibles, and out-of-pocket expenses, and knowing the difference between in-network and out-of-network services.

What types of mental health services are typically covered by insurance?

Common services include therapy, counseling, psychiatric evaluations, medication management, and inpatient treatment. However, limitations or restrictions may apply.

How can I evaluate the quality of mental health coverage in different insurance plans?

You can assess quality by comparing accessibility and availability of services, researching the reputation of insurance companies, and understanding the level of coverage offered.

What are mental health parity laws and how do they impact insurance coverage?

Mental health parity laws ensure that mental health services are covered on par with physical health services, improving access to treatment and protecting individuals seeking mental health care.