Low-cost health insurance for freelancers and gig workers sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

As freelancers and gig workers navigate the complexities of the modern workforce, securing affordable health insurance becomes a crucial aspect of their financial planning and well-being. This guide explores the various options available and provides valuable insights for those seeking cost-effective coverage.

Overview of low-cost health insurance options for freelancers and gig workers

Health insurance is crucial for freelancers and gig workers as it provides financial protection in case of unexpected medical expenses. However, these individuals often face challenges in accessing affordable health insurance due to the lack of employer-sponsored plans and the high cost of individual insurance policies.

Key Challenges Faced by Freelancers and Gig Workers

- Lack of employer-sponsored health insurance benefits

- High cost of individual health insurance plans

- Inconsistent income making it difficult to afford traditional insurance premiums

- Limited options for coverage tailored to the needs of freelancers and gig workers

Benefits of Low-cost Health Insurance Plans for Freelancers and Gig Workers

- Affordable premiums designed to fit the budget of freelancers and gig workers

- Flexible coverage options that can be customized based on individual needs

- Access to essential health benefits without breaking the bank

- Opportunity to join group health plans or health sharing ministries for cost-effective coverage

Types of low-cost health insurance available

When it comes to low-cost health insurance options for freelancers and gig workers, there are several types of plans to consider. These plans are designed to provide essential coverage at affordable rates, catering to the unique needs of individuals in non-traditional work arrangements.

Health Maintenance Organizations (HMOs)

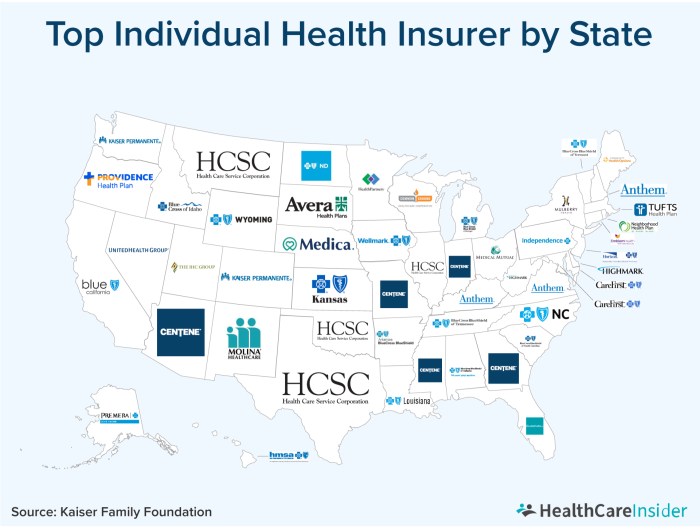

- HMOs are known for their cost-effective approach to healthcare, requiring members to choose a primary care physician and obtain referrals for specialist visits.

- Examples of insurance providers offering HMO plans include Kaiser Permanente and Blue Cross Blue Shield.

- While HMOs offer lower premiums, they may have limited provider networks and require members to stay within the network for coverage.

Preferred Provider Organizations (PPOs)

- PPO plans offer more flexibility in choosing healthcare providers, allowing members to see specialists without referrals.

- Insurance providers like UnitedHealthcare and Aetna offer PPO plans with varying levels of coverage and cost.

- Although PPOs offer more freedom of choice, they generally come with higher premiums compared to HMOs.

High-Deductible Health Plans (HDHPs) with Health Savings Accounts (HSAs)

- HDHPs come with lower premiums but higher deductibles, making them suitable for those looking to save on monthly costs.

- Providers like Cigna and Humana offer HDHPs with the option to open an HSA for tax-advantaged savings towards medical expenses.

- Individuals opting for HDHPs should consider their ability to cover the high deductible before seeking medical care.

Eligibility criteria and application process

To qualify for low-cost health insurance as a freelancer or gig worker, individuals typically need to meet specific eligibility requirements set by the insurance provider. These criteria may vary depending on the type of insurance plan and the state in which you reside.

Eligibility Requirements

- Proof of self-employment: Freelancers and gig workers often need to provide documentation proving their self-employment status, such as tax returns, invoices, or business licenses.

- Income verification: Some low-cost health insurance options may have income limits, so applicants may need to provide proof of income to demonstrate financial need.

- State residency: Eligibility for certain health insurance programs may be restricted to individuals who are residents of a particular state.

Application Process

- Research available options: Start by researching the different low-cost health insurance plans available for freelancers and gig workers in your state.

- Complete the application: Once you have chosen a plan that fits your needs, carefully fill out the application form, providing accurate information and supporting documents as required.

- Submit the application: After completing the application, submit it according to the instructions provided by the insurance provider. Make sure to double-check all information before submission.

- Follow up: Stay in touch with the insurance provider to track the progress of your application and address any additional requirements or inquiries promptly.

Tip: Keep all relevant documents organized and readily accessible during the application process to streamline the verification and approval procedures.

Cost-saving strategies and subsidies

When it comes to reducing the financial burden of health insurance premiums for freelancers and gig workers, there are several cost-saving strategies and subsidies available to help make coverage more affordable.

Utilizing Cost-Saving Strategies

- Compare Different Plans: Take the time to compare different health insurance plans to find one that offers the best value for your specific needs and budget.

- High Deductible Plans: Opting for a high deductible plan can help lower monthly premiums, but be prepared to pay more out of pocket in case of medical expenses.

- Health Savings Account (HSA): Consider opening an HSA to save money on a pre-tax basis to use towards qualified medical expenses, such as deductibles and copayments.

- Telemedicine Services: Utilize telemedicine services for non-emergency medical consultations to save on time and costs associated with in-person visits.

Understanding Subsidies and Financial Assistance

Subsidies or financial assistance programs provided by the government can help lower-income freelancers and gig workers afford health insurance premiums. These subsidies are typically based on income level and family size, and can significantly reduce the monthly costs of coverage.Additionally, subsidies can improve the overall affordability and quality of health coverage by making comprehensive plans more accessible to those who may not have been able to afford them otherwise.

By reducing the financial burden, subsidies can ensure that freelancers and gig workers have access to essential healthcare services without compromising their financial stability.

Closure

In conclusion, low-cost health insurance options tailored for freelancers and gig workers offer a beacon of hope in an otherwise challenging landscape. By understanding the nuances of these insurance plans and leveraging cost-saving strategies, individuals can safeguard their health without breaking the bank.

Essential Questionnaire

What are the eligibility requirements for low-cost health insurance for freelancers and gig workers?

To qualify for low-cost health insurance, freelancers and gig workers typically need to demonstrate proof of income and may be required to meet certain criteria based on the insurance provider's guidelines.

How can freelancers and gig workers benefit from subsidies in health insurance plans?

Subsidies can help reduce the financial burden of health insurance premiums for freelancers and gig workers, making quality coverage more accessible. Eligibility for subsidies is often based on income levels and other factors.

What are some common coverage limitations of low-cost health insurance plans for freelancers and gig workers?

Low-cost health insurance plans may have restrictions on network providers, limited coverage for certain medical services or treatments, and higher out-of-pocket costs. It's important for individuals to carefully review the policy details to understand these limitations.