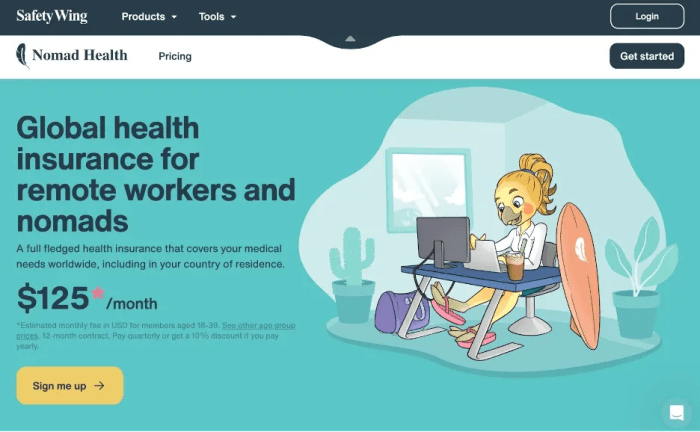

Embark on a journey to explore the realm of affordable international health insurance for expats. Delve into the intricacies of coverage options, benefits, and essential factors to consider while navigating the world of health insurance abroad.

Overview of Affordable International Health Insurance for Expats

Affordable international health insurance for expats refers to insurance plans specifically designed to provide medical coverage for individuals living and working abroad. These insurance policies offer a range of benefits tailored to meet the unique healthcare needs of expatriates in different countries.

Having international health insurance coverage while living abroad is essential for expats to ensure access to quality healthcare services without incurring exorbitant out-of-pocket expenses. Medical emergencies can arise unexpectedly, and having the right insurance in place can provide peace of mind and financial protection.

Key Benefits of Opting for Affordable International Health Insurance

- Global Coverage: Affordable international health insurance plans typically offer coverage worldwide, allowing expats to seek medical treatment in various countries without limitations.

- Access to Quality Healthcare: These insurance policies provide access to a network of healthcare providers, ensuring expats receive high-quality medical care wherever they are located.

- Emergency Evacuation Services: In the event of a medical emergency that requires transportation to a different location for treatment, international health insurance may cover the costs associated with emergency evacuation services.

- Customizable Plans: Expats have the flexibility to choose insurance plans that cater to their specific needs, including options for coverage levels, deductibles, and additional benefits.

- Peace of Mind: By having affordable international health insurance, expats can rest assured that they are prepared for any unforeseen medical expenses and emergencies while living abroad.

Factors to Consider When Choosing Affordable International Health Insurance

When choosing affordable international health insurance as an expat, there are several crucial factors to consider to ensure you have the right coverage for your needs. It's essential to look at different coverage options and understand what each plan offers in terms of medical emergencies, routine check-ups, and pre-existing conditions.

Coverage Options for Expats

- Emergency Medical Coverage: Make sure the plan provides comprehensive coverage for medical emergencies, including hospitalization, surgeries, and ambulance services.

- Routine Check-ups and Preventive Care: Look for a plan that covers routine check-ups, vaccinations, and preventive care to maintain your overall health.

- Pre-Existing Conditions: Check if the insurance plan covers pre-existing conditions, as this can be crucial for managing chronic illnesses or ongoing medical needs.

- Specialist Consultations: Ensure that the plan includes coverage for specialist consultations and treatments, especially if you have specific healthcare needs.

Significance of Coverage for Medical Emergencies, Routine Check-ups, and Pre-Existing Conditions

-

Medical Emergencies:

Having coverage for medical emergencies is essential to ensure you receive timely and adequate care in case of unexpected health issues.

-

Routine Check-ups:

Regular check-ups and preventive care help in early detection of health problems and maintaining overall well-being.

-

Pre-Existing Conditions:

Coverage for pre-existing conditions is crucial for managing chronic illnesses and accessing necessary treatments without financial burden.

Best Practices for Finding Affordable International Health Insurance

When it comes to finding affordable international health insurance as an expat, there are several best practices to keep in mind. From researching and comparing insurance providers to understanding deductibles, premiums, and coverage limits, here are some key tips to help you secure the right plan for your needs.

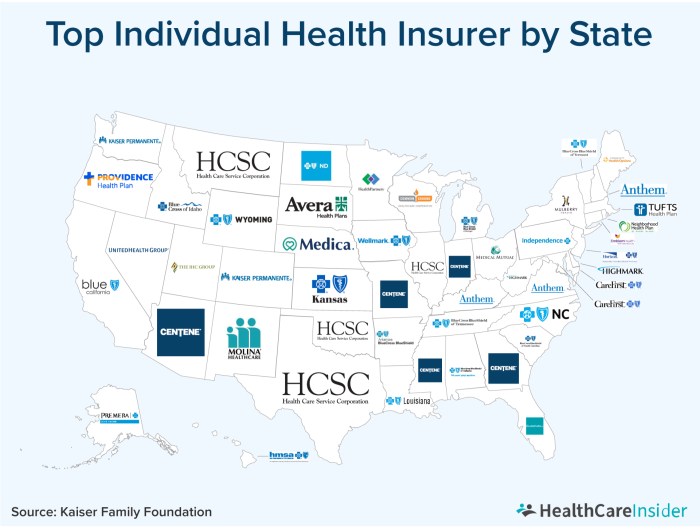

Research and Compare Insurance Providers

- Start by researching reputable insurance providers that offer coverage for expats in your destination country.

- Compare the benefits, network of healthcare providers, and customer reviews of each insurance provider to make an informed decision.

- Consider seeking recommendations from other expats or local professionals who may have valuable insights.

Understand Deductibles, Premiums, and Coverage Limits

- Take the time to understand how deductibles, premiums, and coverage limits impact the overall cost of your insurance plan.

- Opt for a higher deductible if you are comfortable with paying more out of pocket in exchange for lower monthly premiums.

- Ensure that the coverage limits of the plan align with your healthcare needs and provide adequate protection in case of emergencies.

Negotiate Better Rates and Customize Plans

- Don't hesitate to negotiate with insurance providers to see if you can secure a better rate or additional benefits.

- Consider customizing your insurance plan to include specific coverage options that are important to you, such as maternity care or dental services.

- Be prepared to ask questions and seek clarification on any aspects of the insurance policy that are unclear to ensure you are getting the best value for your money.

Common Challenges and Solutions in Accessing Affordable International Health Insurance

Securing affordable international health insurance as an expat can be a challenging task due to various obstacles that may arise. It is essential to be aware of these challenges and have solutions in place to overcome them effectively.

Language Barriers

One common obstacle expats face when trying to access affordable international health insurance is language barriers. Navigating complex insurance policies in a foreign language can be daunting and may lead to misunderstandings or misinterpretations.

- Seek assistance from bilingual professionals or translators who can help you understand the terms and conditions of the insurance policy.

- Consider working with insurance brokers who are fluent in both languages to ensure clear communication and avoid any language-related issues.

- Utilize online resources or tools that offer translations of insurance documents to help you grasp the details more accurately.

Navigating Complex Insurance Policies

Understanding the intricacies of international health insurance policies can be overwhelming, especially when dealing with different regulations and coverage options in a foreign country.

- Consult with insurance experts or professionals who specialize in international health insurance to guide you through the process and explain the policy terms in a clear and concise manner.

- Take the time to thoroughly review the policy documents and ask questions to clarify any doubts or uncertainties before making a decision.

- Consider seeking recommendations from other expats or trusted sources who have experience with affordable international health insurance to gain insights and advice.

Importance of Professional Advice and Reputable Brokers

When it comes to accessing affordable international health insurance, seeking professional advice and working with reputable brokers can make a significant difference in securing the right coverage for your needs.

- Engage with insurance brokers who have a proven track record of assisting expats with affordable health insurance solutions and understand the unique challenges they face.

- Rely on the expertise of insurance professionals who can tailor insurance plans to suit your specific requirements and provide personalized guidance throughout the process.

- Verify the credentials and reputation of insurance brokers or advisors before engaging their services to ensure transparency and reliability in your insurance transactions.

Conclusion

In conclusion, Affordable international health insurance for expats is not just a safety net but a crucial aspect of living abroad. By understanding the key components and challenges, expats can make informed decisions to safeguard their health and well-being while away from home.

Common Queries

What does affordable international health insurance for expats cover?

Affordable international health insurance typically covers medical emergencies, routine check-ups, hospitalization, and sometimes dental and vision care.

How can expats find the most suitable insurance provider?

Expats can research online, seek recommendations from other expats, and compare coverage, premiums, and deductibles to find the best fit for their needs.

Are pre-existing conditions covered under affordable international health insurance?

Some plans may offer coverage for pre-existing conditions, but it's crucial to review the policy details carefully.

Can expats customize their insurance plans?

Yes, many insurance providers offer options to customize plans based on individual needs, such as adding or removing certain coverage elements.