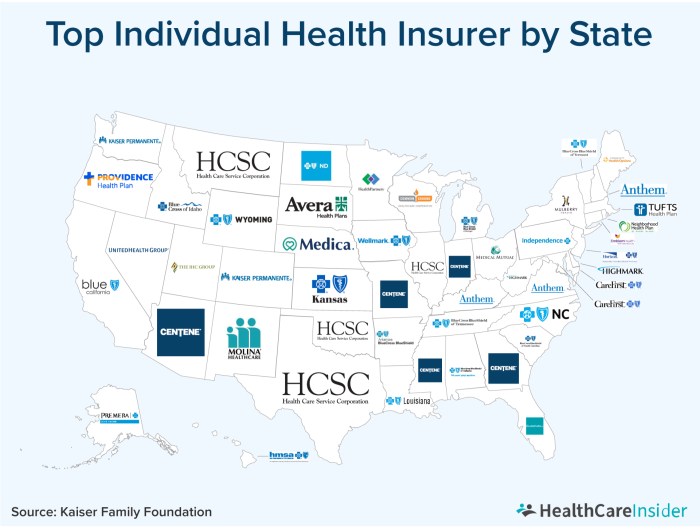

Embark on a journey to explore the top private health insurance plans in the US for 2025. This guide aims to provide valuable insights and information to help you make informed decisions about your healthcare coverage.

As we delve deeper into the realm of private health insurance, we will uncover key features, coverage details, and cost factors that play a crucial role in selecting the best plan for your needs.

Overview of Private Health Insurance Plans

Private health insurance refers to insurance coverage that individuals purchase directly from a private insurance company to cover healthcare expenses. It is different from public health insurance programs, such as Medicare or Medicaid, which are funded by the government.

Key Features of Private Health Insurance Plans

- Customizable Coverage: Private health insurance plans offer a range of coverage options that can be tailored to individual needs and budgets.

- Provider Network: These plans often come with a network of healthcare providers, hospitals, and specialists that policyholders can choose from.

- Premiums and Deductibles: Policyholders pay monthly premiums and may have to meet a deductible before the insurance starts covering costs.

- Add-On Benefits: Some private plans offer additional benefits like dental, vision, or mental health coverage.

- Coverage for Alternative Treatments: Private plans may cover treatments like acupuncture, chiropractic care, or naturopathy.

Comparison with Other Types of Health Insurance

Private health insurance plans differ from public health insurance programs in terms of coverage, cost, and accessibility. While private plans offer more flexibility and choice, they can be more expensive than public options. Employer-sponsored health insurance is another common type that is offered through employers to their employees, often with shared costs between the employer and employee.

Factors Influencing the Best Private Health Insurance Plans

When individuals are choosing a private health insurance plan, there are several key factors that influence their decision-making process. These factors can vary depending on personal needs, financial situations, and overall health goals. Understanding these factors is crucial in determining the best private health insurance plan for an individual.

Cost and Affordability

Cost is one of the primary factors that individuals consider when selecting a health insurance plan. Premiums, deductibles, co-pays, and out-of-pocket expenses all contribute to the overall cost of the plan. Affordability is essential to ensure that individuals can access necessary healthcare services without facing financial hardship.

Coverage and Benefits

The coverage and benefits offered by a health insurance plan play a significant role in decision-making. Individuals look for plans that provide comprehensive coverage for a wide range of medical services, including preventive care, prescription drugs, specialist visits, and hospital stays.

Additionally, benefits such as telemedicine, mental health services, and wellness programs are becoming increasingly important.

Provider Network

The provider network associated with a health insurance plan is another crucial factor. Individuals want access to a broad network of healthcare providers, including primary care physicians, specialists, hospitals, and clinics. Having the option to choose healthcare providers that meet their preferences and needs is essential for many individuals.

Quality of Care

The quality of care provided by a health insurance plan is a key consideration. Individuals want assurance that they will receive high-quality healthcare services when needed. Factors such as patient outcomes, customer satisfaction ratings, and accreditation of healthcare facilities all contribute to the perceived quality of care.

Healthcare Policies and Regulations

Changes in healthcare policies and regulations can have a significant impact on private health insurance plans. Reforms, legislation, and government initiatives can influence the cost, coverage, and accessibility of health insurance plans. It is essential for individuals to stay informed about these changes to make informed decisions about their health insurance coverage.

Technology and Innovation

Advancements in technology and innovation are shaping the landscape of private health insurance plans. Telemedicine, digital health tools, and personalized healthcare solutions are becoming increasingly prevalent in health insurance offerings. Individuals are looking for plans that embrace these technological advancements to improve access to care and enhance overall health outcomes.

Coverage and Benefits of Top Private Health Insurance Plans

Private health insurance plans in the US offer a wide range of coverage and benefits to their members. These plans aim to provide comprehensive healthcare services and financial protection in case of medical emergencies.

Types of Coverage Provided

- Hospitalization coverage: This includes inpatient care, surgery, and hospital stays.

- Outpatient care: Coverage for doctor visits, diagnostic tests, and preventive services.

- Prescription drug coverage: Assistance with the cost of medications prescribed by healthcare providers.

- Mental health services: Coverage for therapy, counseling, and treatment for mental health conditions.

- Maternity and newborn care: Coverage for prenatal care, delivery, and postnatal care for both the mother and baby.

Benefits Offered

- Preventive care: Coverage for routine check-ups, screenings, and vaccinations to prevent illnesses.

- Prescription drugs: Assistance with the cost of prescription medications to manage chronic conditions.

- Mental health services: Access to therapy, counseling, and treatment for mental health conditions.

- Dental and vision care: Coverage for routine dental exams, cleanings, eye exams, and eyeglasses or contact lenses.

- Telemedicine services: Virtual consultations with healthcare providers for non-emergency medical issues.

Comparison of Coverage and Benefits

| Insurance Plan | Coverage | Benefits |

|---|---|---|

| Plan A | Hospitalization, outpatient care | Preventive care, prescription drugs |

| Plan B | Hospitalization, mental health services | Dental and vision care, telemedicine services |

| Plan C | Prescription drug coverage, maternity care | Mental health services, preventive care |

Cost and Affordability of Private Health Insurance Plans

When considering private health insurance plans, one of the key factors that consumers look at is the cost and affordability. The cost of private health insurance plans can vary depending on a variety of factors, including the level of coverage, deductibles, co-pays, and premiums.

Factors Influencing the Cost of Private Health Insurance Plans

- The level of coverage: Plans that offer more comprehensive coverage tend to have higher premiums.

- Deductibles and co-pays: Plans with lower deductibles and co-pays usually have higher premiums.

- Age and health status: Younger and healthier individuals typically pay lower premiums compared to older individuals or those with pre-existing conditions.

- Location: The cost of healthcare can vary by region, impacting the cost of insurance plans.

Strategies to Make Private Health Insurance Plans More Affordable

- Consider high-deductible plans: Opting for a plan with a higher deductible can lower monthly premiums.

- Utilize health savings accounts (HSAs): HSAs allow individuals to save pre-tax dollars to pay for medical expenses, reducing out-of-pocket costs.

- Shop around and compare plans: It's essential to explore different insurance providers and plans to find the most cost-effective option.

- Take advantage of employer-sponsored plans: Many employers offer group health insurance plans with lower premiums for employees.

Impact of Cost on Access to Healthcare

The cost of private health insurance plans can directly impact an individual's access to healthcare. High premiums or out-of-pocket costs may deter individuals from seeking necessary medical care, leading to delayed treatment or forgoing healthcare altogether.

Last Recap

In conclusion, the landscape of private health insurance plans in the US for 2025 offers a diverse array of options to cater to various healthcare needs. With a focus on coverage, benefits, and affordability, individuals can navigate the complexities of insurance to secure optimal healthcare solutions.

FAQ Guide

What are the key features of private health insurance plans?

Private health insurance plans typically offer a wide range of coverage options, including hospital stays, prescription drugs, and preventive care services.

How do changes in healthcare policies impact private health insurance plans?

Changes in healthcare policies can influence the cost and coverage of private health insurance plans, potentially affecting access to certain services or treatments.

What strategies can be employed to make private health insurance plans more affordable?

Consumers can explore options such as high-deductible plans, health savings accounts, or seeking subsidies to help make private health insurance more affordable.