Exploring the realm of Family health insurance plans with dental and vision unveils a world of possibilities and benefits. As we delve into the intricate details of coverage and care, a tapestry of insights awaits to guide you through the maze of insurance options.

In the following sections, we will unravel the complexities surrounding family health insurance plans, shedding light on the importance of dental and vision coverage for your loved ones' well-being.

Overview of Family Health Insurance Plans with Dental and Vision

Family health insurance plans with dental and vision coverage typically include a range of benefits beyond just medical coverage. These plans often cover preventive dental services, routine vision exams, and sometimes even eyeglasses or contact lenses. By combining all these aspects into one comprehensive plan, families can ensure they have access to all the necessary healthcare services they need.Including dental and vision coverage in a family health insurance plan is essential for overall well-being.

Regular dental check-ups can help prevent serious oral health issues, while routine vision exams can detect early signs of eye diseases. Neglecting these aspects of healthcare can lead to more significant problems down the line, impacting both physical health and finances.According to a study by the National Association of Dental Plans, individuals with dental coverage are more likely to visit the dentist regularly, resulting in better oral health outcomes.

Similarly, regular eye exams can detect various health conditions such as diabetes and hypertension early on, reducing the risk of complications. Comprehensive health insurance for families not only promotes preventive care but also provides financial protection in case of unexpected medical expenses.

Types of Family Health Insurance Plans Available

When it comes to family health insurance plans that include dental and vision coverage, there are several options available to choose from. Each type of plan offers different benefits and coverage levels, so it's essential to understand the differences to make an informed decision for your family's healthcare needs.

Health Maintenance Organization (HMO) Plans

- HMO plans require you to choose a primary care physician (PCP) who will coordinate all of your family's healthcare needs.

- You must receive referrals from your PCP to see specialists or receive specialized care.

- Typically, HMO plans offer lower out-of-pocket costs but have a more restricted network of healthcare providers.

Preferred Provider Organization (PPO) Plans

- PPO plans allow you to see any healthcare provider, both in-network and out-of-network, without requiring a referral.

- While you have more flexibility in choosing providers, PPO plans generally have higher premiums and out-of-pocket costs.

- These plans are beneficial if you prefer more freedom in selecting healthcare providers for your family.

Exclusive Provider Organization (EPO) Plans

- EPO plans combine features of both HMO and PPO plans, offering a balance of cost savings and provider choice.

- Like PPO plans, EPOs do not require referrals to see specialists, but they have a more limited network of providers like HMOs.

- These plans are ideal for families looking for cost-effective options with some provider flexibility.

Point of Service (POS) Plans

- POS plans combine aspects of HMO and PPO plans, allowing you to choose in-network or out-of-network providers.

- Similar to HMOs, you need a referral from your PCP to see specialists, but you can still seek care outside the network.

- POS plans offer a good balance between cost savings and provider options for families.

Eligibility Criteria for Enrolling

To enroll in a family health insurance plan with dental and vision coverage, you typically need to meet certain eligibility criteria, such as being a legal resident of the country where the plan is offered, providing proof of family relationship for all members included in the plan, and meeting any income requirements set by the insurance provider.

Popular Insurance Providers Offering Comprehensive Coverage

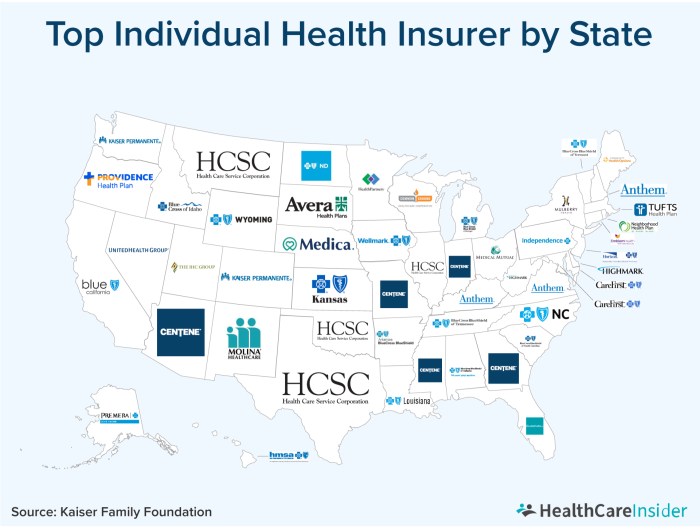

Some popular insurance providers that offer comprehensive family health insurance plans with dental and vision coverage include:

- Blue Cross Blue Shield

- Aetna

- Cigna

- UnitedHealthcare

These providers have a range of plan options to suit different family needs and budgets, ensuring that you can find the right coverage for your family's healthcare needs.

Benefits of Including Dental and Vision Coverage

Including dental and vision coverage in a family health insurance plan can provide numerous benefits to all family members. Let's explore the advantages of having these additional coverages

Dental Coverage Benefits:

- Access to preventive care: Dental insurance encourages regular check-ups and cleanings, which can help prevent more serious oral health issues in the future.

- Reduced out-of-pocket costs: Having dental coverage can lower the cost of common procedures like fillings, root canals, and extractions.

- Improved overall health: Good oral health is linked to better overall health, as dental problems can contribute to conditions such as heart disease and diabetes.

- Emergency dental care: Dental insurance can help cover the costs of unexpected dental emergencies, providing peace of mind for the whole family.

Vision Coverage Benefits:

- Regular eye exams: Vision insurance covers the cost of eye exams, ensuring that family members of all ages maintain healthy vision.

- Prescription eyewear: Coverage for eyeglasses and contact lenses can significantly reduce the out-of-pocket expenses for necessary vision correction.

- Early detection of eye conditions: Routine eye exams can help detect eye conditions like glaucoma or cataracts early, leading to better treatment outcomes.

- Preventative care: Vision insurance encourages regular eye check-ups, which can help identify vision problems before they worsen.

Preventive dental and vision care can positively impact overall family health by catching problems early, reducing the risk of more serious health issues, and promoting a healthier lifestyle for all family members.

Cost Considerations and Affordability

When it comes to family health insurance plans with dental and vision coverage, the cost can vary depending on several factors. These factors can include the number of family members covered, the level of coverage desired, the insurance provider, and the location of the insured individuals.

Understanding these factors can help families find affordable options without compromising on coverage.

Factors Influencing Cost

- The number of family members covered: The more family members included in the plan, the higher the cost will be.

- Level of coverage: Plans with more comprehensive coverage, including dental and vision, may have higher premiums.

- Insurance provider: Different insurance companies offer varying rates for similar coverage, so it's essential to compare quotes.

- Location: The cost of health care can vary by region, impacting the overall cost of insurance premiums.

Tips for Finding Affordable Options

- Shop around and compare quotes from different insurance providers to find the best rates.

- Consider high-deductible plans coupled with Health Savings Accounts (HSAs) for potential cost savings.

- Look for group insurance plans through employers or professional organizations for potentially lower rates.

- Explore government-sponsored programs like Medicaid or CHIP for eligible family members to reduce costs.

Cost-Saving Strategies

- Opt for generic medications when possible to save on prescription drug costs.

- Utilize in-network providers to avoid higher out-of-pocket expenses.

- Take advantage of preventive services covered by insurance to avoid costly medical treatments down the line.

- Consider telemedicine options for non-emergency medical consultations to save on office visit fees.

Final Summary

In conclusion, the journey through the landscape of Family health insurance plans with dental and vision leaves us with a profound understanding of the significance of comprehensive coverage. Embracing the pillars of dental and vision care within your family's insurance plan is a step towards safeguarding their health and future.

FAQ

What does family health insurance with dental and vision typically cover?

Family health insurance plans with dental and vision usually cover preventive care, basic services, major procedures, and vision exams and eyewear.

How can families find affordable options for health insurance with dental and vision coverage?

Families can explore options like group plans through employers, government programs, or subsidies to find affordable family health insurance plans with dental and vision.

Why is vision coverage important for family members of all ages?

Vision coverage is crucial for detecting eye issues early, ensuring proper vision care, and maintaining overall eye health for family members of all ages.

What factors influence the cost of family health insurance plans with dental and vision?

The cost of family health insurance plans with dental and vision can be influenced by coverage limits, deductibles, copayments, and the insurance provider's pricing.