Exploring the realm of Health insurance tips for chronic illness management, this introduction sets the stage for a comprehensive discussion on navigating the complexities of healthcare with a focus on chronic conditions.

Providing valuable insights and practical advice, this guide aims to empower individuals dealing with chronic illnesses to make informed decisions regarding their health insurance coverage.

Importance of Health Insurance for Chronic Illness Management

Health insurance plays a crucial role in managing chronic illnesses by providing financial support for necessary medical care.

Cost Coverage for Medications and Treatments

Health insurance helps cover the costs of medications, treatments, and therapies required to manage chronic conditions. This ensures that individuals can afford the necessary care without worrying about financial constraints.

Access to Specialists and Medical Services

Having health insurance improves access to specialists and necessary medical services for chronic illness management. This ensures that individuals can receive the specialized care they need to effectively manage their condition and prevent complications.

Peace of Mind and Ongoing Healthcare Support

Health insurance provides peace of mind by offering a safety net for ongoing healthcare needs. Knowing that you have insurance coverage can alleviate stress and anxiety related to managing a chronic illness, allowing individuals to focus on their health and well-being.

Choosing the Right Health Insurance Plan

When it comes to managing chronic illnesses, choosing the right health insurance plan is crucial. It can significantly impact the quality of care and the financial burden on individuals. Here are key factors to consider when selecting a health insurance plan for chronic illness management:

Types of Health Insurance Plans

- Health Maintenance Organizations (HMOs): These plans typically require you to choose a primary care physician and get referrals to see specialists. They may offer lower out-of-pocket costs but have a more limited network of providers.

- Preferred Provider Organizations (PPOs): PPO plans offer more flexibility in choosing healthcare providers without needing referrals. While they may have higher premiums, they provide more extensive provider networks.

- High-Deductible Health Plans: These plans have lower premiums but higher deductibles. They are often paired with Health Savings Accounts (HSAs) to cover out-of-pocket costs.

Reviewing Coverage

- Prescription Medications: Make sure the plan covers the medications you need for managing your chronic condition. Check for any restrictions or requirements for coverage.

- Specialist Visits: Look into how the plan handles visits to specialists for your condition. Ensure that you have access to the healthcare providers you need.

- Hospitalizations: Understand the coverage for hospital stays related to your chronic illness. Check for any limitations on the number of days or types of services covered.

Evaluating Costs and Network Coverage

- Out-of-Pocket Costs: Consider your budget and how much you can afford to pay for medical expenses beyond premiums. Look at copayments, coinsurance, and deductibles.

- Deductibles: Determine the amount you must pay out of pocket before the insurance coverage kicks in. Consider how this will impact your finances throughout the year.

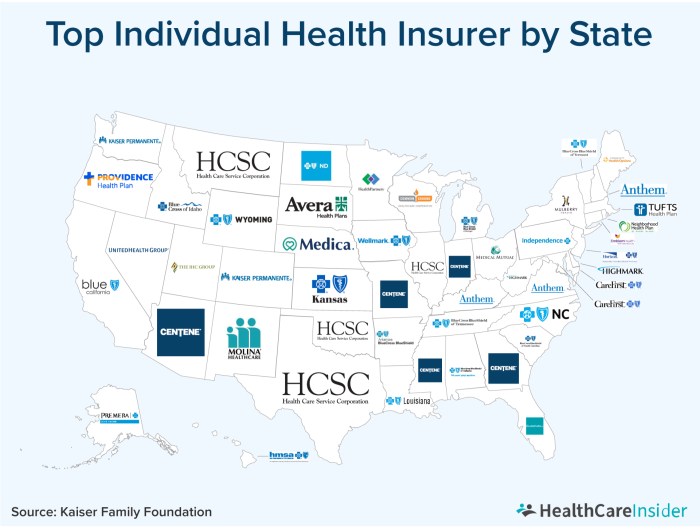

- Network Coverage: Check if your preferred healthcare providers are in-network to maximize coverage and minimize out-of-pocket costs. Understand the implications of using out-of-network providers.

Maximizing Health Insurance Benefits

When managing a chronic illness, it is crucial to maximize your health insurance benefits to ensure you receive the necessary care and support. Here are some strategies to help you make the most of your health insurance coverage:

Utilizing Preventive Care Services

Preventive care services are essential for managing chronic conditions proactively. Take advantage of services such as annual check-ups, screenings, and vaccinations covered by your health insurance plan. These preventive measures can help detect and manage health issues early on, reducing the risk of complications.

- Regularly schedule preventive screenings recommended for your specific chronic illness.

- Stay up to date on vaccinations to prevent illnesses that could exacerbate your condition.

- Discuss with your healthcare provider about any additional preventive care measures that may benefit your condition.

Understanding Your Health Insurance Policy

To maximize your health insurance benefits, it is crucial to understand your policy in detail. Be aware of coverage limits, pre-authorization requirements for certain treatments, and the appeals process in case a claim is denied. Knowing these details can help you navigate the healthcare system more effectively.

Always review your health insurance policy documents carefully to understand what services are covered and any limitations or restrictions that may apply.

Navigating Insurance Paperwork and Claims

Dealing with insurance paperwork, claims, and billing can be overwhelming, but it is essential to ensure you receive the full benefits entitled to you. Keep detailed records of all medical expenses, claims, and communications with your insurance provider. Stay organized and proactive in following up on any discrepancies or denials to resolve issues promptly.

- Keep copies of all medical bills, receipts, and insurance correspondence.

- Verify that services billed are accurately reflected in your insurance claims.

- Appeal any claim denials with supporting documentation from your healthcare provider if necessary.

Advocating for Coverage and Support

When managing a chronic illness, advocating for coverage and support from insurance providers is crucial to accessing necessary treatments, medications, and services. Effective communication and support from patient advocacy organizations, support groups, and healthcare providers can make a significant difference in navigating the complexities of health insurance.

Strategies for Advocating with Insurance Providers

- Research and gather information about the specific treatment, medication, or service you are advocating for to present a strong case to your insurance provider.

- Keep detailed records of your medical history, prescriptions, and treatment plans to support your advocacy efforts.

- Work with your healthcare provider to provide any necessary documentation or medical evidence to support the need for coverage.

Effective Communication with Insurance Companies

- Be persistent and assertive in your communication with insurance companies when addressing coverage denials, claim disputes, or prior authorization challenges.

- Clearly articulate your needs and concerns, and provide any additional information requested by the insurance company in a timely manner.

- Stay informed about your insurance policy and rights as a policyholder to advocate effectively for the coverage you are entitled to receive.

Role of Patient Advocacy Organizations and Support Groups

- Joining patient advocacy organizations or support groups can provide valuable resources, guidance, and emotional support when advocating for coverage and support from insurance providers.

- These organizations can help individuals understand their insurance benefits, navigate the appeals process, and connect with others facing similar challenges.

- Healthcare providers can also play a key role in advocating for their patients by providing medical expertise and documentation to support coverage requests.

Examples of Successful Advocacy Efforts

- A patient advocacy group successfully lobbied for a change in insurance policy to cover a specific medication that significantly improved the quality of life for individuals with a rare chronic condition.

- A collaborative effort between healthcare providers and a patient's family led to the approval of a life-saving treatment that was initially denied coverage by the insurance company.

- Through persistent communication and support from a patient advocacy organization, an individual was able to overturn a coverage denial for a costly medical procedure essential for managing their chronic illness.

Last Point

As we conclude this insightful journey into Health insurance tips for chronic illness management, it becomes evident that having the right insurance plan can make a significant difference in the quality of care and support for those managing chronic conditions.

FAQ Overview

How can health insurance help cover the costs of medications for chronic conditions?

Health insurance can assist in covering the expenses of prescription medications by reducing out-of-pocket costs through copayments or coinsurance.

What factors should be considered when selecting a health insurance plan for chronic illness management?

Key factors to consider include coverage for specialist visits, prescription drugs, and hospitalizations, as well as the network of healthcare providers available under the plan.

How can individuals advocate for coverage of specific treatments related to chronic illness management?

Advocacy efforts can be made by providing supporting documentation from healthcare providers, appealing coverage denials, and seeking assistance from patient advocacy organizations.